estate tax changes in reconciliation bill

Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction.

What Are Marriage Penalties And Bonuses Tax Policy Center

Net Investment Income Tax Expanded 138203.

. Instead it contains three primary changes affecting estate and gift taxes. The revised version of the bill however does not include these provisions restricting the use of valuation discounts. Although these prior major tax proposals are not.

The corporate tax rate would begin at. At the same time the bill would raise taxes substantially for those making 1 million or more according to a new analysis by the Tax Policy Center. The current proposal is to create a progressive corporate income tax similar to what is currently used to calculate personal income tax.

Estate and Gift Tax Changes Proposed. The 117M per person gift and estate tax exemption will remain in place and will be increased. And that means a global minimum tax of 15 percent.

The House Ways and Means Committee released its tax law proposal the House Proposal to be incorporated in a budget reconciliation bill on Monday September 13 2021. The clock would start after Dec. Possible Changes to Estate and Gift Tax Law.

The Legislation includes significant tax proposals that if passed will dramatically change the tax and estate planning landscape for high-income and high-net worth individuals. It would apply a 5 rate above income of 10 million with an additional 3 surtax on income above 25 million. No Changes to the Current Gift and Estate Exemption Provisions Until 2025.

Estate and gift tax exemption. Under the proposal for tax year 2022 individuals could face a 464 combined tax rate on ordinary income a 396 ordinary rate plus 38 net investment income tax or self. Reconciliation Bill has Significant Proposed Changes for Estate Gift and Income Taxes.

Individual rate increases. The proposal reduces the exemption from estate and gift taxes from. Under current law a 38 tax is imposed on Net.

1 day agoCongress will return next week with modest hopes. 5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget.

Growth and Tax Relief Reconciliation Act of 2001 EGTRRA. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most of the proposed changes to the estate tax law. The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate planning.

The many changes floated since the presidential and congressional elections of 2020 would have reduced the. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain. The amended change would raise the cap to.

The House budget reconciliation bill HR. If the bill passes impacted IRA owners will have two years to make the change or face full taxation of all assets in the IRA. Effective January 1 2022.

107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. The Build Back Better Framework released. An individual rate increase to 396 and top capital gains rate increase to 25 as proposed in the Ways and Means bill are doubtful since Sen.

A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million. The Democrats effort to pass a budget reconciliation bill remains stalled. Last week the House Ways and Means Committee released a draft of proposed tax law changes to include in a reconciliation.

Potential Tax Impact on Estate Planning. This is estimated to bring in 230 billion over 10 years.

Senate Democrats Prepare To Tweak House Reconciliation Package

How Could We Reform The Estate Tax Tax Policy Center

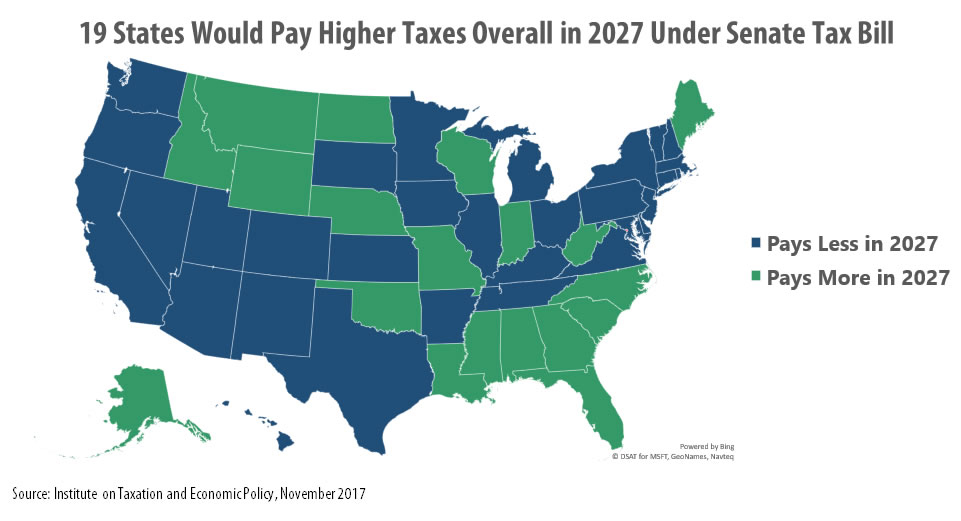

Mick Mulvaney And The 19 States Paying Higher Taxes Under The Senate Tax Bill Itep

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Everything In The House Democrats Budget Bill The New York Times

Democrats Tweak Tax Bill For House Vote Grant Thornton

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

How The Tcja Tax Law Affects Your Personal Finances

The Tax Cuts And Jobs Act Doesn T Comply With The Byrd Rule Committee For A Responsible Federal Budget

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Here S Why The Gop Tax Reform Might Only Be Temporary

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Everything In The House Democrats Budget Bill The New York Times

How The Tcja Tax Law Affects Your Personal Finances

Billionaires Tax On Capital Gains Invites Tax Collection Volatility