delayed draw term loan accounting

DDTLs are usually used by businesses that would like to purchase capital refinance debt or make acquisitions. Another name for a Tranche B Term Loan.

Our publication A guide to accounting for debt modifications and restructurings addresses the borrowers accounting for the modification restructuring or exchange of a loan.

. This gets you around 1239mo for the full payments and 70833mo for the interest-only payments. A TDR occurs when a creditor for economic or legal reasons related to the debtors financial difficulty grants the debtor a more than insignificant concession that it would not otherwise consider. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time period ie the reporting entity gets to choose the date that the debt funds within a.

A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. The revolving loans are approved for the short-term usually up to one year. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and.

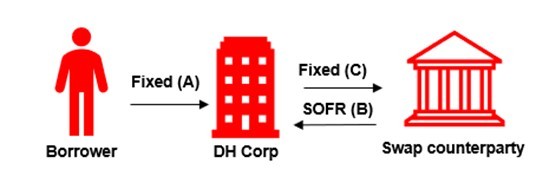

DELAYED DRAW TERM LOAN AGREEMENT. The Borrower shall repay the outstanding principal amount of the Delayed Draw Term Loan on the last Business Day of each Fiscal Quarter commencing with the first 1st Fiscal Quarter of 2019 in each case in an amount equal to one and one-quarter percent 125 of the outstanding principal amount of the Delayed Draw Term Loan as of the last day of the first 1st Fiscal. Like revolvers delayed-draw loans carry fees on the unused portion of the facilities.

The update impacts both private and public companies and applies to term loans bonds and any borrowing that has a defined payment schedule. And WACHOVIA BANK NATIONAL ASSOCIATION as Co. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them.

The primary purpose for DDTLs is to fund additional. Another name for a Negative Assurance Letter. Another name for the Investment Company Act.

Another name for a Tranche A Term Loan. A company borrows 100 million in a 5-year term loan and incurs 5 million in financing fees. The amount recorded is termed the loan principal.

DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt and thus the additional. Another name for the Exchange Act. Financing fees example.

A cash management technique that involves a company paying vendors andor other creditors by checks drawn on banks located in remote areas. These ticking fees start at 1. However they can also be attached to unitranche financing.

Below is an example of debt issuance costs treatment pre- and post-ASU 2015-03. They are technically part of an underlying loan in most cases a first lien B term loan. In this case an asset cash increases as the money is received into the bank account of the business and a liability loan increases representing the amount owed to the bank in accordance with the loan agreement.

A transaction involving the issuance of a new term loan or debt security to one lender or investor and the concurrent satisfaction of an existing term loan or debt security to another unrelated lender or investor is always accounted for as an extinguishment of the existing debt and issuance of new debt. Another name for the Securities Act. The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125 of the aggregate.

Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years. The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125 of the aggregate. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction.

THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING INC. While you may enjoy the flexibility and save money on. The amendment provides for among other things an increase to the existing term loan facility in the amount of 400 million Incremental Term Loans and a new delayed.

This CLE course will discuss the terms and structuring of delayed draw term loans. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

Another name for a Rule 10b-5 Representation. The accounting implications differ depending on whether the borrowers or lenders accounting is being considered. Amortize the loan amount for 120 months with payments due Feb 1 2015 through Jan 1 2015 and run a 12-month interest-only loan for 100000 with payments due Feb 1 2014 through Jan 1 2015.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. The primary decision points considered by the. Key Takeaways A delayed draw term loan DDTL allows you to withdraw funds from one loan amount several times through predetermined.

A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. This contrasts with commitment fees on revolvers of 50bp. Determining whether a loan modification constitutes a TDR is a two-step process.

The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in. Commercial banks will typically. A separate loan account should be established in the balance sheet for each loan.

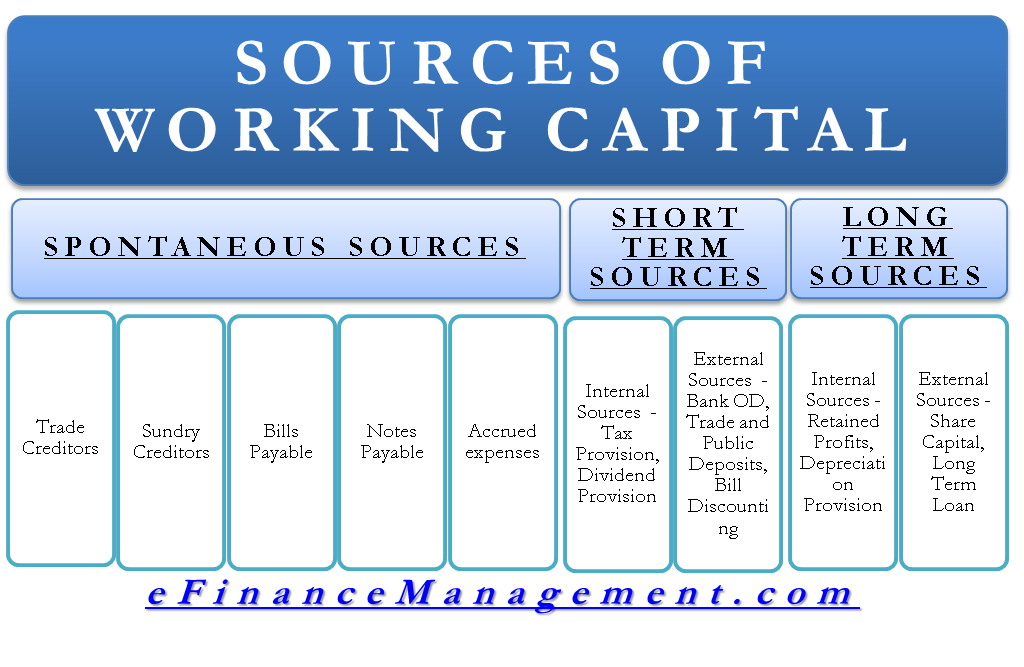

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Personal Finance Organization

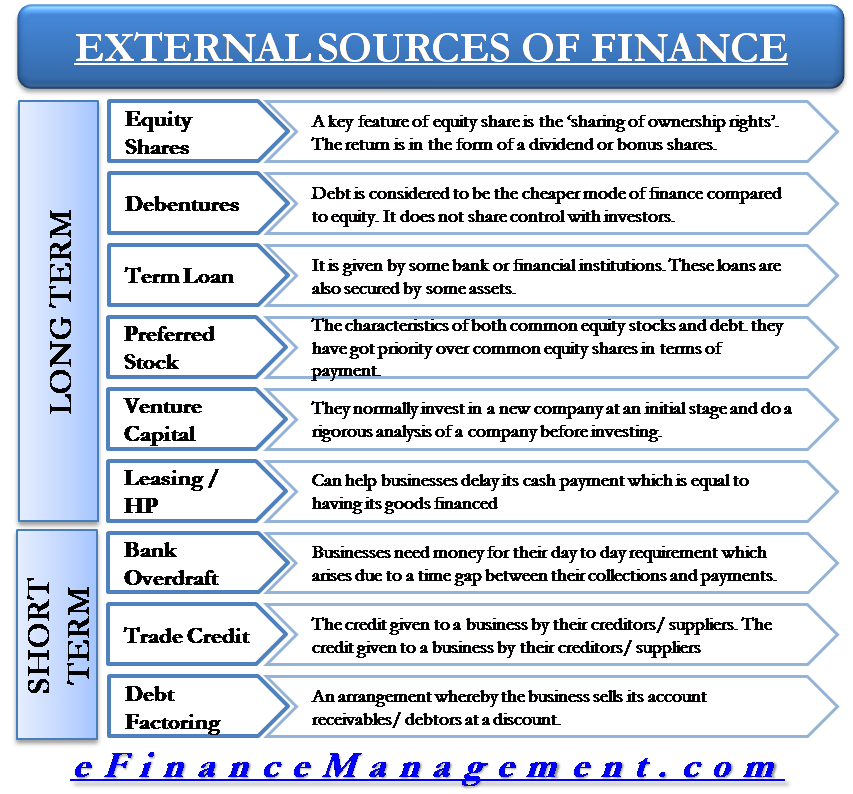

External Sources Of Finance Capital

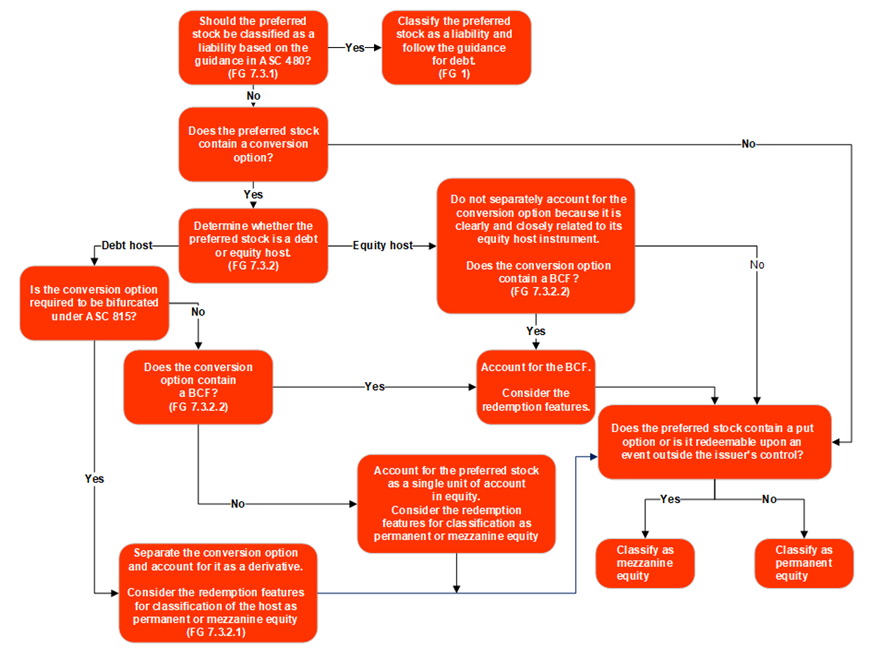

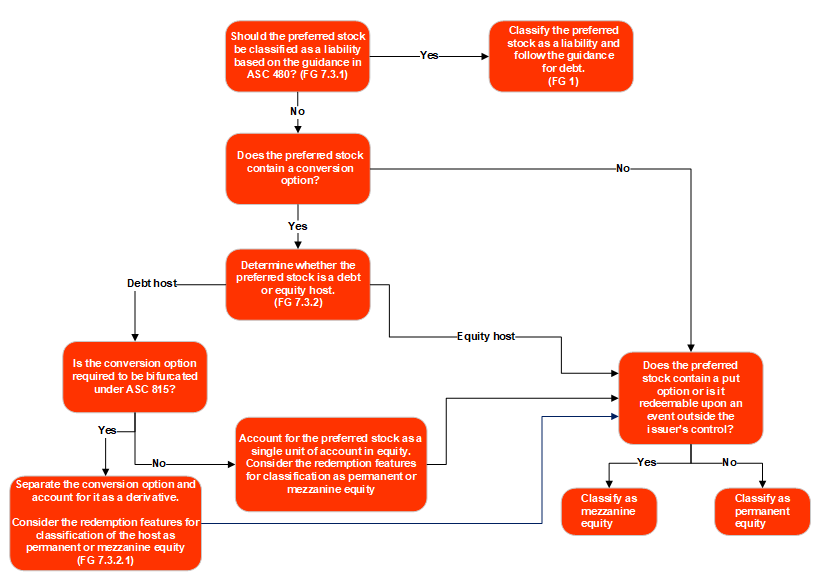

7 3 Classification Of Preferred Stock

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Delayed Draw Term Loan Ddtl Overview Structure Benefits

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

The Benefits Of Long Term Vs Short Term Financing

Financing Fees Deferred Capitalized Amortized

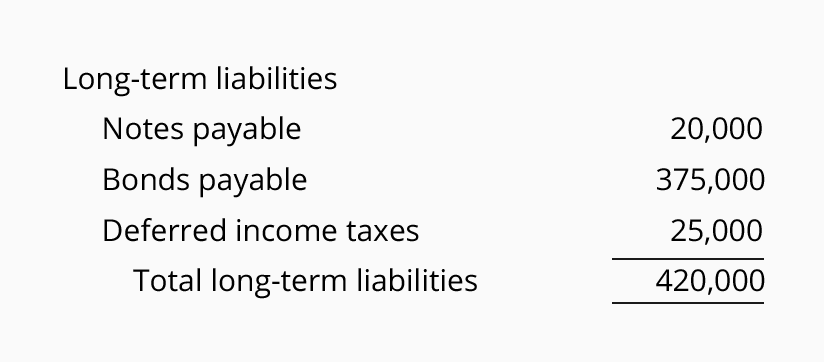

Balance Sheet Long Term Liabilities Accountingcoach

Financing Fees Deferred Capitalized Amortized

7 3 Classification Of Preferred Stock

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

Financing Fees Deferred Capitalized Amortized

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

Understanding The Construction Draw Schedule Propertymetrics